Last-Minute Tax Extension Strategies Every Owner Should Know

When tax season blindsides you, the worst move is freezing up or filing rushed, error-filled returns. A tax extension isn’t a failure — it’s a tactical lever that buys you time, protects accuracy, and helps you avoid IRS trouble. The key is knowing how to use that extra time strategically, not just as a delay button.

At Straight Talk CPAs, we’ve helped owners who waited too long, panicked, and left money on the table — and others who used extensions to unlock deductions they’d otherwise miss. The difference comes down to execution.

Here’s how to make a last-minute extension work for you instead of against you.

1. File the Extension Before the Deadline — No Exceptions

You can’t negotiate with the IRS clock. Form 4868 (for individuals) and Form 7004 (for businesses) must be submitted on time if you want automatic extension approval.

What most owners don’t realize:

An extension gives more time to file, not more time to pay.

If you owe taxes, the IRS still expects a good faith estimated payment. Miss it, and penalties start stacking.

Pro Move:

Run a quick projection of what you might owe using your previous year’s return plus this year’s income trends. Paying a little extra now is cheaper than penalties later.

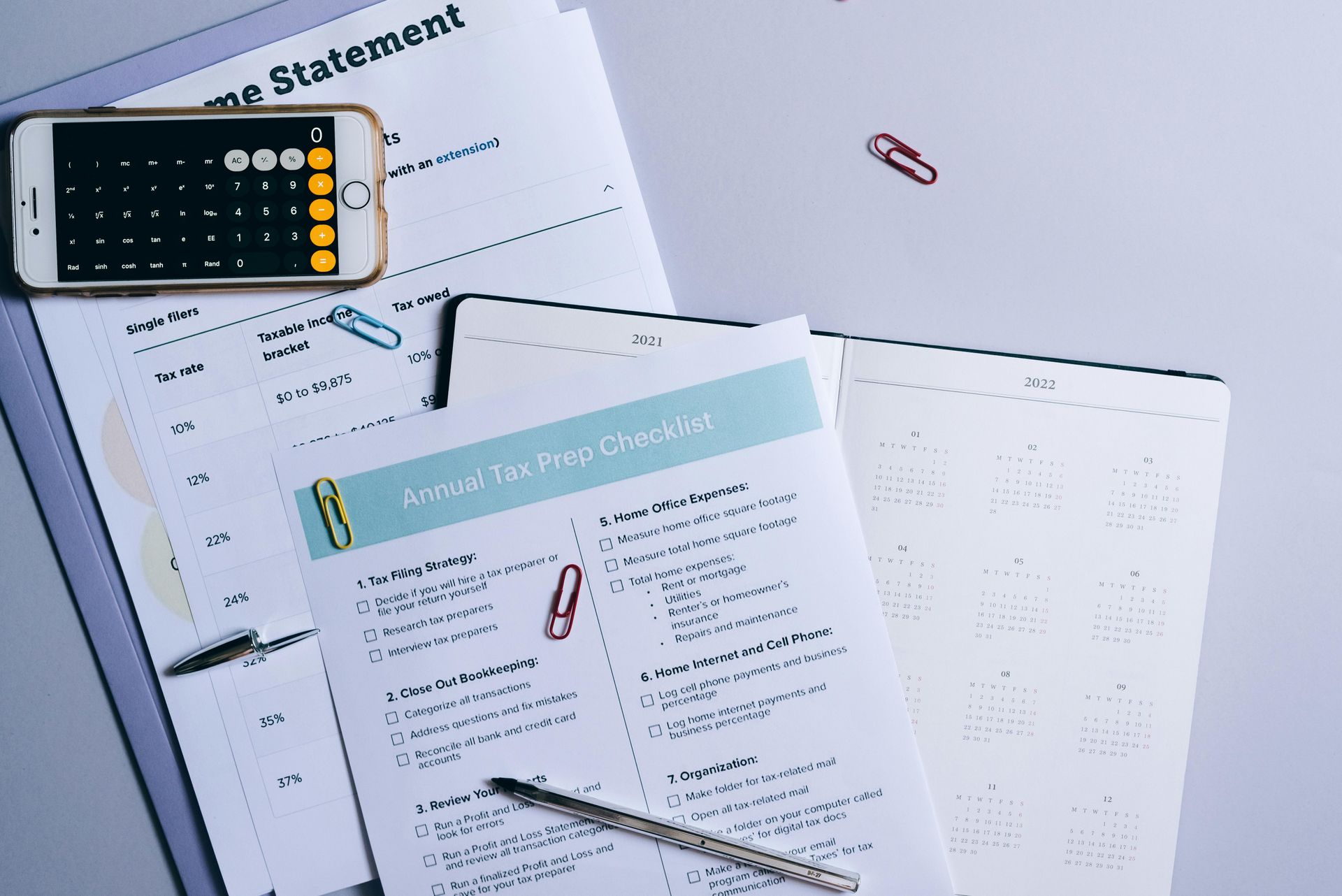

2. Use the Extra Time to Capture Missed Deductions

Most owners rush filings and overlook major deductions in the process — especially if their bookkeeping isn’t clean.

Use the extension window to:

- Reconcile all bank and credit card transactions

- Upload missing receipts

- Review mileage, home office, and equipment purchases

- Re-check contractor payments and 1099s

- Evaluate eligible Section 179 or bonus depreciation opportunities.

These missed details often translate into thousands in savings. Filing an extension creates the breathing room you need to claim

everything.

3. Fix Bookkeeping Gaps That Could Trigger an Audit

Sloppy books are an audit magnet. The extension gives you time to tighten financial records so you file a clean, defensible return.

Audit flags you can clean up during the extension period include:

- Large unexplained expenses

- High contractor payments without matching 1099s

- Personal charges mixed with business spending.

- Missing documentation for asset purchases

Owners who rush these details often regret it later. The IRS doesn’t care that you were in a hurry.

4. Review Your Entity Structure for Tax Efficiency

Extensions create a strategic pause — a chance to assess whether you’re operating under the most tax-efficient structure (LLC, S-Corp, C-Corp).

You can’t switch structures retroactively for the year, but you can use this time to:

- Assess whether your income level justifies an S-Corp

- Evaluate payroll vs. distributions.

- Review how your current structure impacts deductions and self-employment taxes.

If the numbers don’t add up, the right structure can save you significantly next year.

5. Bring in a CPA Who Can Turn the Extra Time into Real Savings

A tax extension is only powerful if you pair it with an expert strategy. A CPA can help you:

- Optimize deductions

- Clean up records

- Avoid penalties

- Make accurate estimated payments.

- File a compliant, defensible return.

Straight Talk CPAs focuses on actionable, pressure-free strategies that keep you compliant while maximizing what you keep.

Common Mistakes Owners Make with Extensions

Avoid these costly missteps:

- Thinking that an extension delays tax payment

- Filing extension forms incorrectly

- Making a “zero” estimated payment

- Ignoring bookkeeping gaps

- Submitting disorganized documents to your CPA in October

A tax extension is a tool — but only if you use it strategically.

Final Takeaway

A last-minute tax extension isn’t a setback. It’s a strategic move when used correctly. Take the extra time to clean up your books, capture every deduction, protect yourself from penalties, and file a strong return — not a rushed one.

👉

Talk to Straight Talk CPAs today and turn your extension into an advantage, not an emergency.

Free eBook:

Stories of Transformation

Salim is a straight-talking CPA with 30+ years of entrepreneurial and accounting experience. His professional background includes experience as a former Chief Financial Officer and, for the last twenty-five years, as a serial 7-Figure entrepreneur.